Markup and tax calculator

Markup Discount Calculator Help. Calculator to determine the sale price of a discounted item.

Margin Calculator

A mathematical superhero providing web-based calculators.

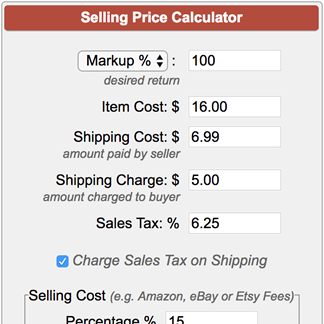

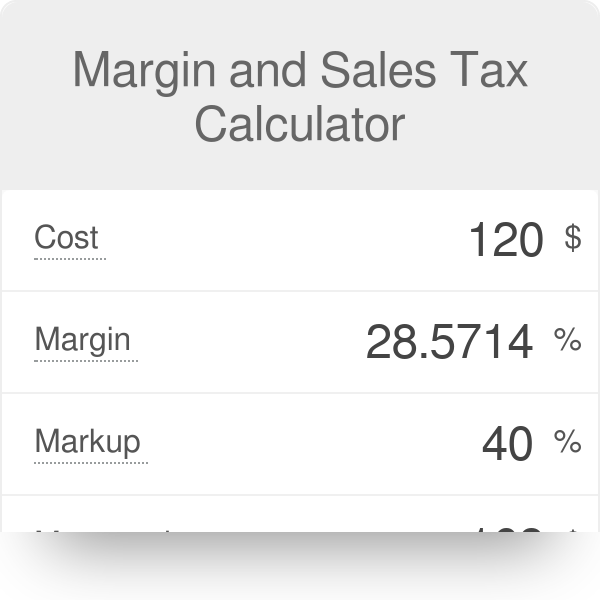

. Can be calculated for the accounting years 2016 to 2018. One of the most common options is dealer cash incentives where a manufacturersuch as GMCwill pay a dealer for every vehicle sold off the lot. The margin and sales tax calculator combines these two issues for your ease - anyone selling anything will need to find the net and gross price based on their desired margin and the sales tax rate at some point.

Ideal Body Weight Calculator. Margin and Markup Calculator. Here we discuss How to Calculate Balance Sheet along with practical examples.

How to Calculate Net Income. If you qualify for the highest credit then the minimum FUTA rate is 6. And if you dont know the rate download our lookup tool to find out.

US Paycheck Tax Calculator. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Calculators online for sales markup margin price profit sale price and sales tax.

Please note that this calculator does not include any tax calculations. Also let a friend know about this super easy calculator. Must contain at least 4 different symbols.

Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. Cost 1 Markup Selling Price and therefore Markup Selling Price Cost - 1 Cost Expense incurred to. The base state sales tax rate in Connecticut is 635.

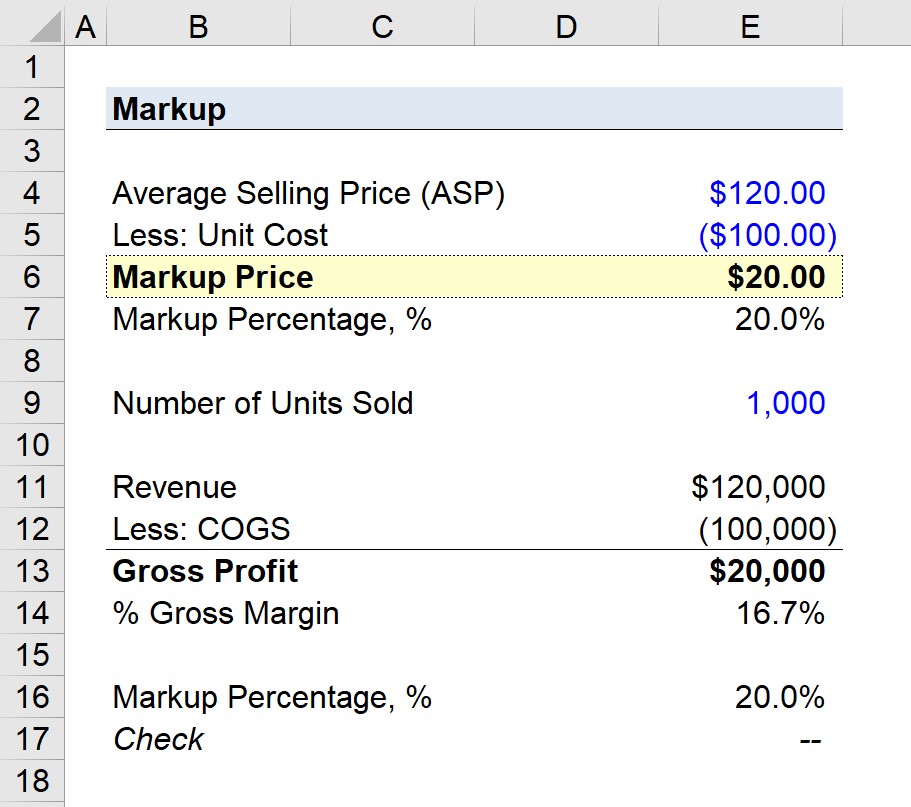

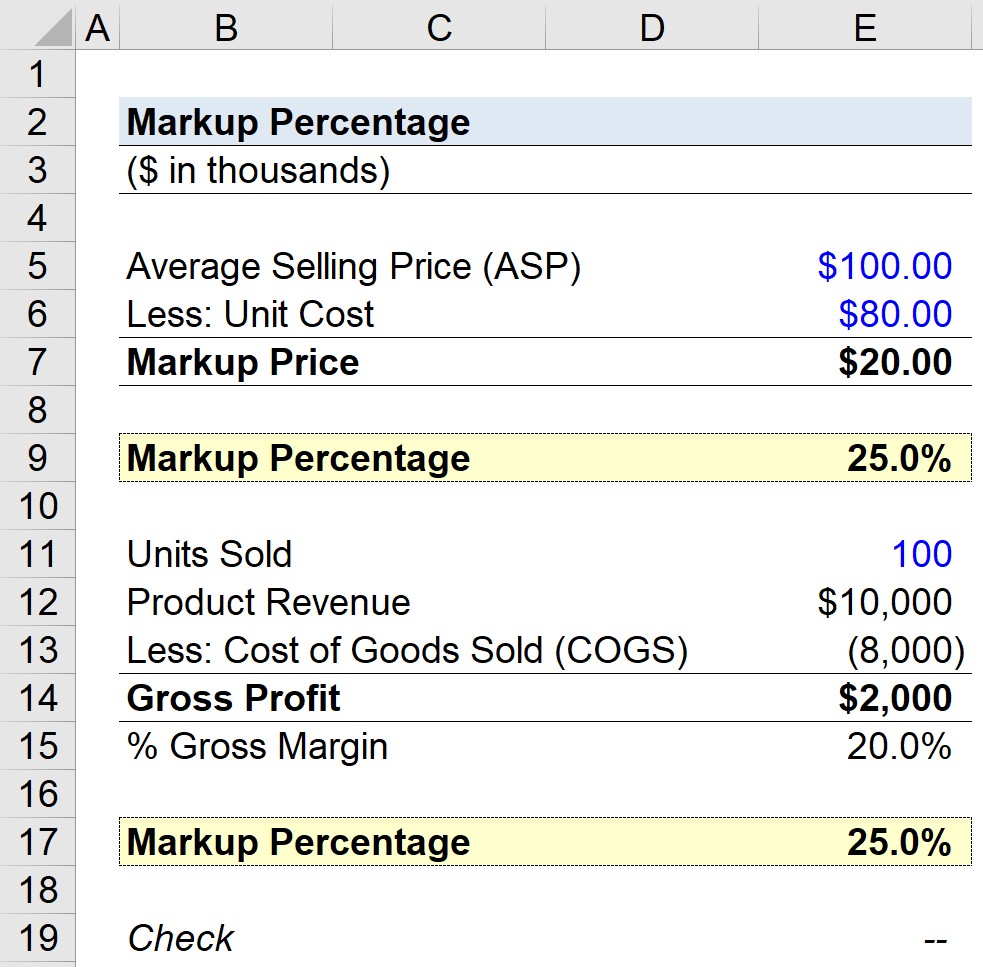

Sales tax is a markup percentage. This has been a guide to Balance Sheet formula. Markup Price Average Selling Price per unit Average Cost price per unit.

Fairfax County Virginia - Department Homepage. It can also be used to calculate the cost - in this case provide your revenue and markup. Annual percentage yield APY is the effective annual rate or real rate of return of an investment if the interest earned each period is compounded.

Please note that there will now be a Planning Commission Action in lieu of a verbatim. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below. It can calculate the gross price based on the net price and the tax rate or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and.

Find your Connecticut combined state and local tax rate. No hidden markup fees. In some businesses accountants and other managers have to simultaneously work with both markups cost or net amount plus a percentage and discounts or mark-downs a total or gross amount less a percentage.

Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for. At the October 27 2021 Planning Commission meeting an update to the Commission bylaws was adopted. Get 247 customer support help when you place a homework help service order with us.

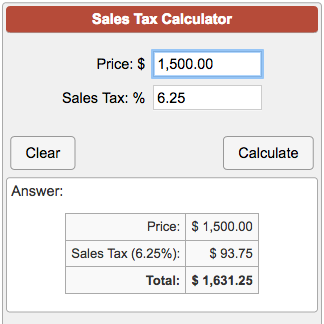

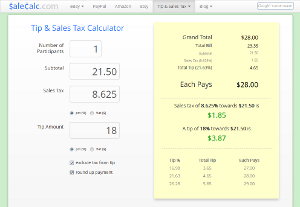

To simplify the process we have created a simple Employee Productivity Calculator Excel Template for the manufacturing salesmarketing and the service industry. Our sales tax calculator will calculate the amount of tax due on a transaction. That result is then added to your total costs to set your selling price.

The markup calculator alternatively spelled as mark up calculator is a business tool most often used to calculate your sale priceJust enter the cost and markup and the price you should charge will be computed instantly. You may also look at the following articles to learn more Consumer Surplus Formula. Read more the Markup of Apple Inc.

Use our sales tax calculator to work out the sales tax and total sale amount by inputting price and sales tax rate. We also provide a Balance Sheet Calculator with downloadable excel template. Tax return receipts helps banks to understand customers credit quality repayment capacity etc.

Let this simple tool take one of the most stressful parts of the business and make it one of the simplest. Another thing that can impact the invoice cost are incentives offered to the dealership by the manufacturer. So basically it is the additional money over and above the cost of the product which the seller would get.

Calculator online to calculate sales tax with a total price. Markup price Sales Revenue Number of Units Sold Cost of Goods Sold Number of Units Sold. We focus on math sports health and financial calculations.

Federal Unemployment Tax FUTA Unemployment taxes paid to the Federal government. 6 to 30 characters long. In this template you need to enter the required data and it will perform the calculations automatically according to.

The below excel template contains the information required for the calculation. In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption. Social Security and Medicare Tax Rate.

Markup Percentage Formula Calculator. Markup in very simple terms is basically the difference between the selling price per unit of the product and the cost per unit associated in making that product. The markup price is used generally by companies to determine what price they should charge to the consumer so that they can turn their business into a profit.

That is we add sales tax to the net amount. Calculate among the sales variables in marginal analysis for cost revenue gross profit gross margin and markup. Markup The percentage applied to Costs incurred to produce and distribute the item.

ASCII characters only characters found on a standard US keyboard. Hourly to Salary Calculator. Life is already chaotic and stressful enough.

Local tax rates in Connecticut range from 635 making the sales tax range in Connecticut 635. US Paycheck Tax Calculator. With these incentives it makes it possible for the dealership to make a profit even when selling at.

The FUTA rate is 60 with a wage base of 7000 and employers can take a credit of up to 54 of taxable income if they pay state unemployment taxes. This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. You can use the following calculator.

Download Corporate Valuation Investment Banking Accounting CFA Calculator others Common Stock Total Equity Preferred Stock Additional Paid-in Capital Retained Earnings Treasury Stock. The calculator can also find the amount of tax included in a gross purchase amount. Feel free to calculate anything you like - you may be interested in how much you of your payment is going to the wholesaler if you provide the gross margin and.

Connecticut sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Markup Calculator And Discount Calculator

Quick Business Calculator Apps On Google Play

Calculate Markup Price And Tax Percentage Java Program Youtube

Calculating For Taxes Markup And Profit

Markup Calculator Formula And Margin Comparison

Selling Price Calculator

Sales Tax Calculator

Margin And Vat Calculator

How To Calculate Sales Tax Youtube

Help Percent Used To Calculate Markup Sales Tax

Zz3anwclwsp Zm

Markup Calculator And Discount Calculator

Markup Calculator And Discount Calculator

Markup Percentage Formula And Calculator

Margin And Sales Tax Calculator

Margin Calculator Markup N1 Apps On Google Play

Tip Sales Tax Calculator Salecalc Com